Problem

Small e-commerce business owners are often caught between the need for rapid financial agility to respond to market opportunities and the complexity of managing credit effectively within the rhythms of their unique business cycles.

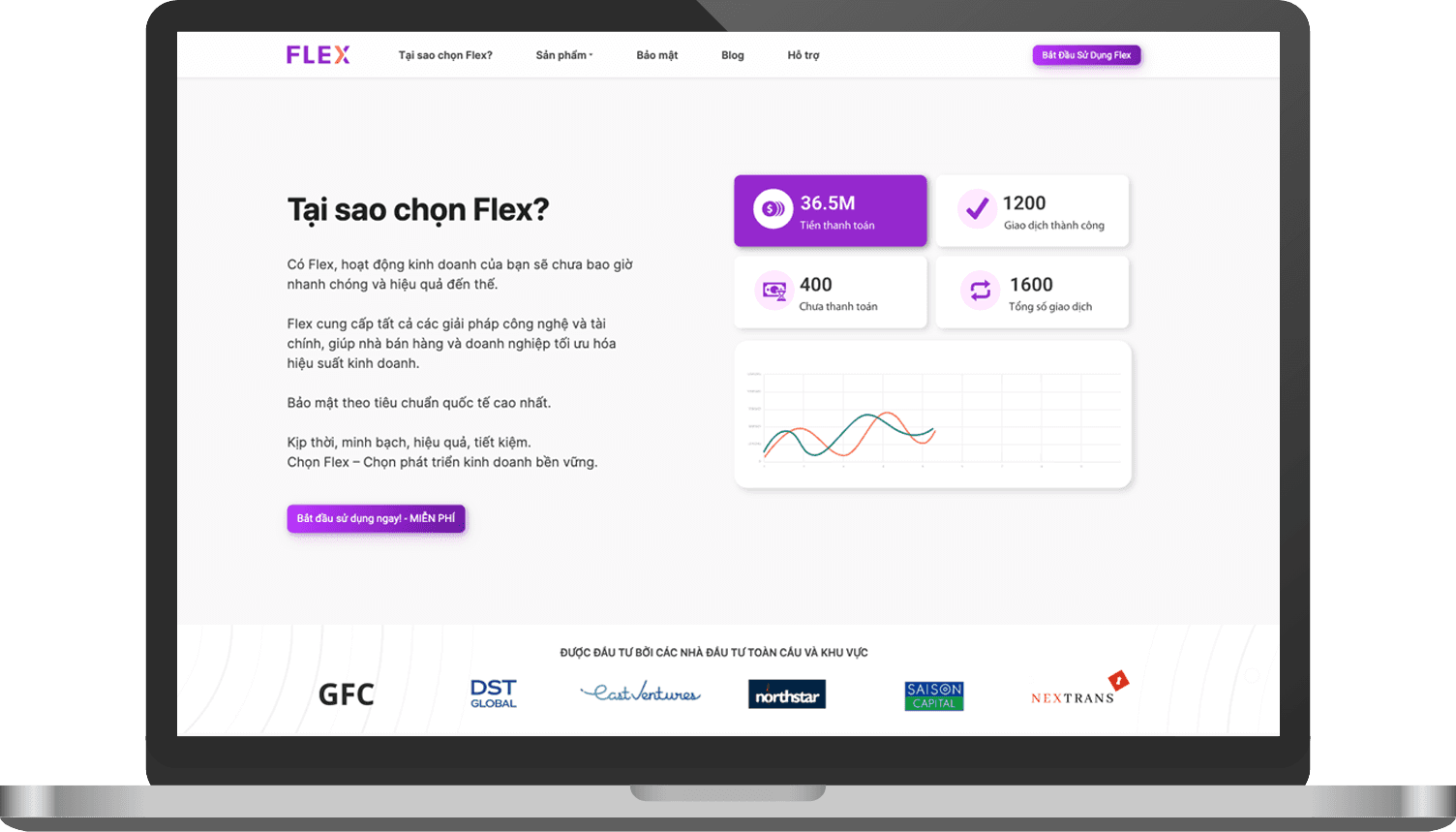

Solution

Flex offers fast, flexible credit solutions fully integrated with e-commerce platforms. It streamlines credit for online businesses with quick approvals, clear terms, and tools for smart financial management.

Insights

Enhance Financial Accessibility

To provide small e-commerce business owners with instant access to flexible credit options

Customize Repayment Structures

To offer flexible repayment plans that can be tailored to align with each business’s cash flow

Financial Health Monitoring

To offer powerful credit monitoring tools in Fex that deliver real-time financial insights and guidance for credit score improvement.

Observations

71%

Loan Approval Time

prioritize fast loan approval to keep pace with market demands

82%

Interest Rates

small business owners consider low-interest rates crucial when choosing a credit service.

68%

Repayment Flexibility

e-commerce businesses look for flexible repayment options that align with their revenue patterns.

75%

Integration E-commerce Platforms

value the ability to integrate credit management directly with their e-commerce platforms.

94%

User Interface

prefer a user-friendly digital interface for managing their loans and credits.

86%

Customer Support

deem responsive customer support as critical when dealing with financial services.

Empathy map

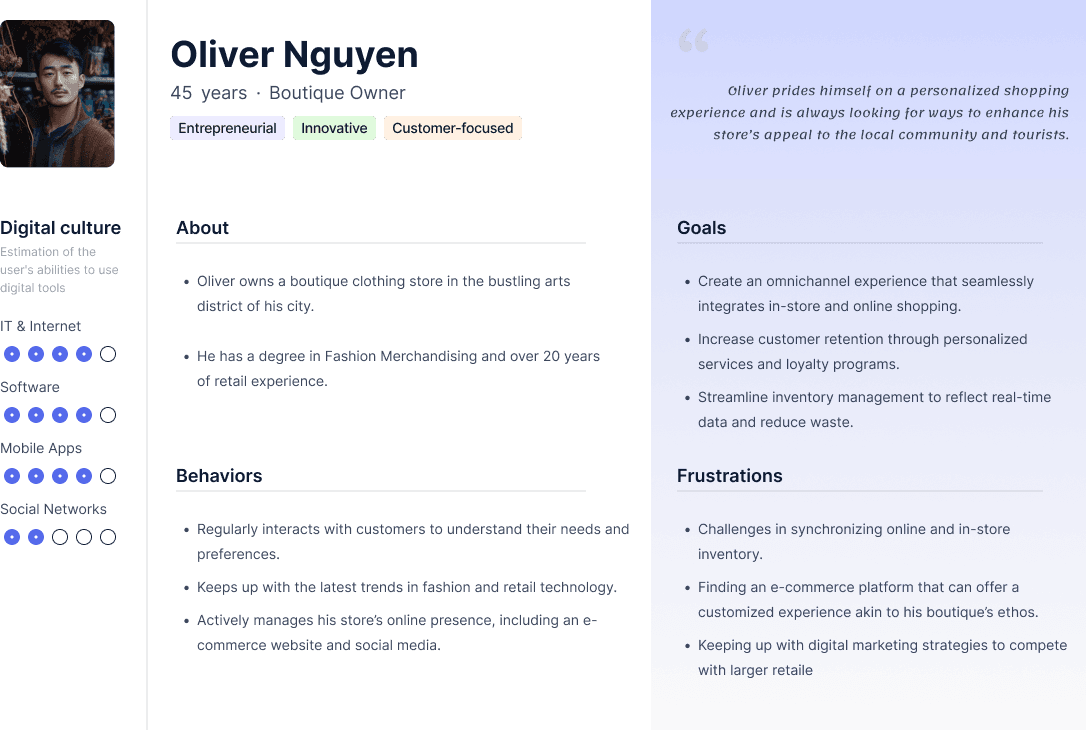

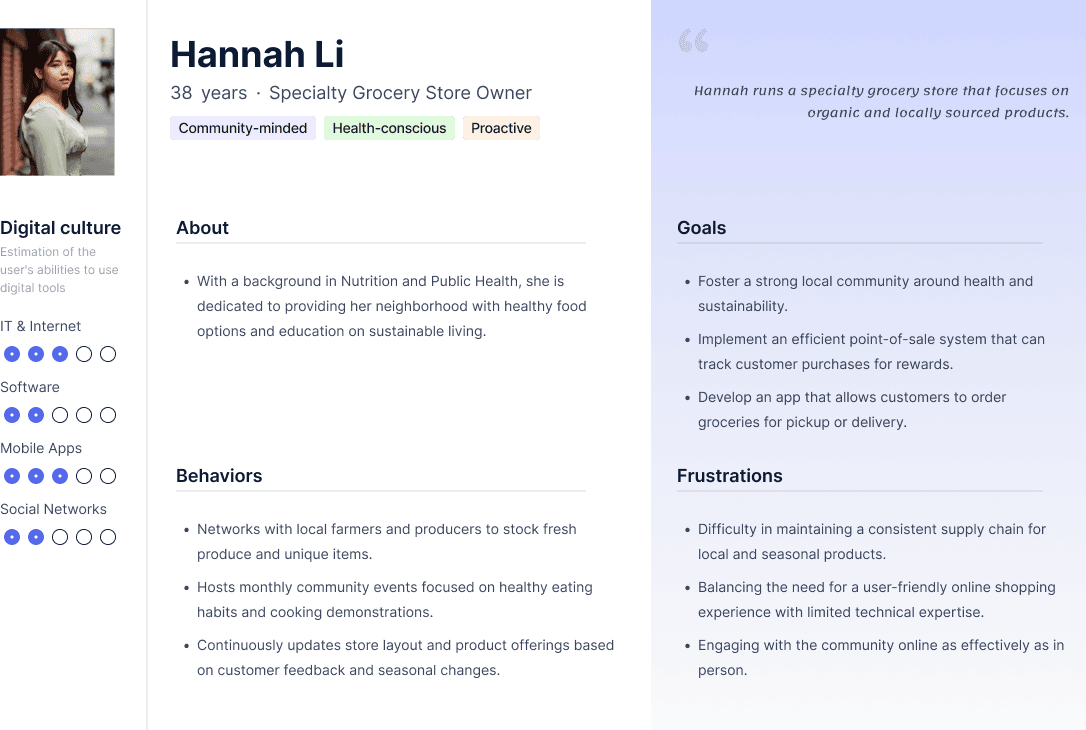

User personas

COMPETITIVE ANALYSIS

USER JOURNEY

Information architech

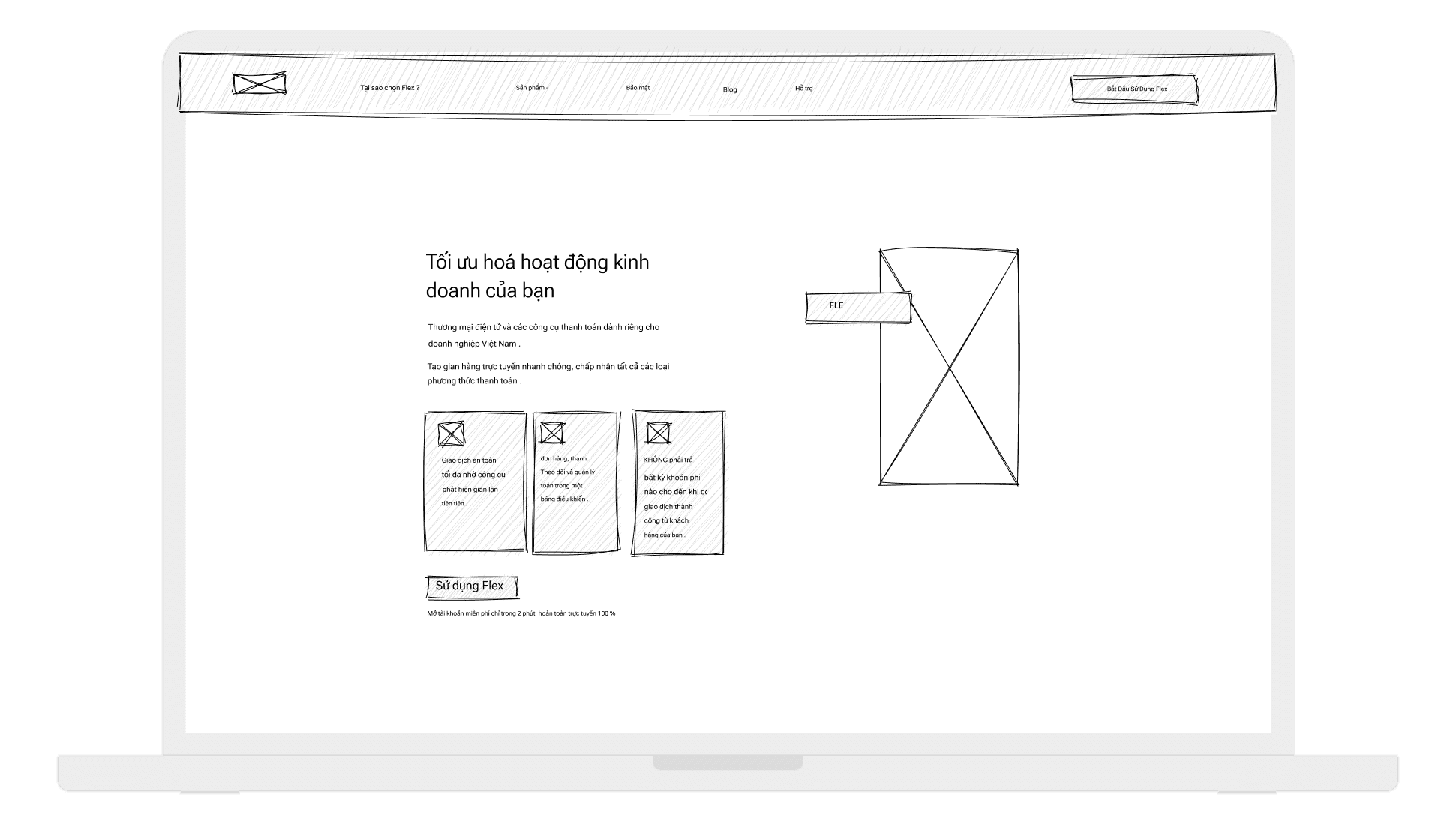

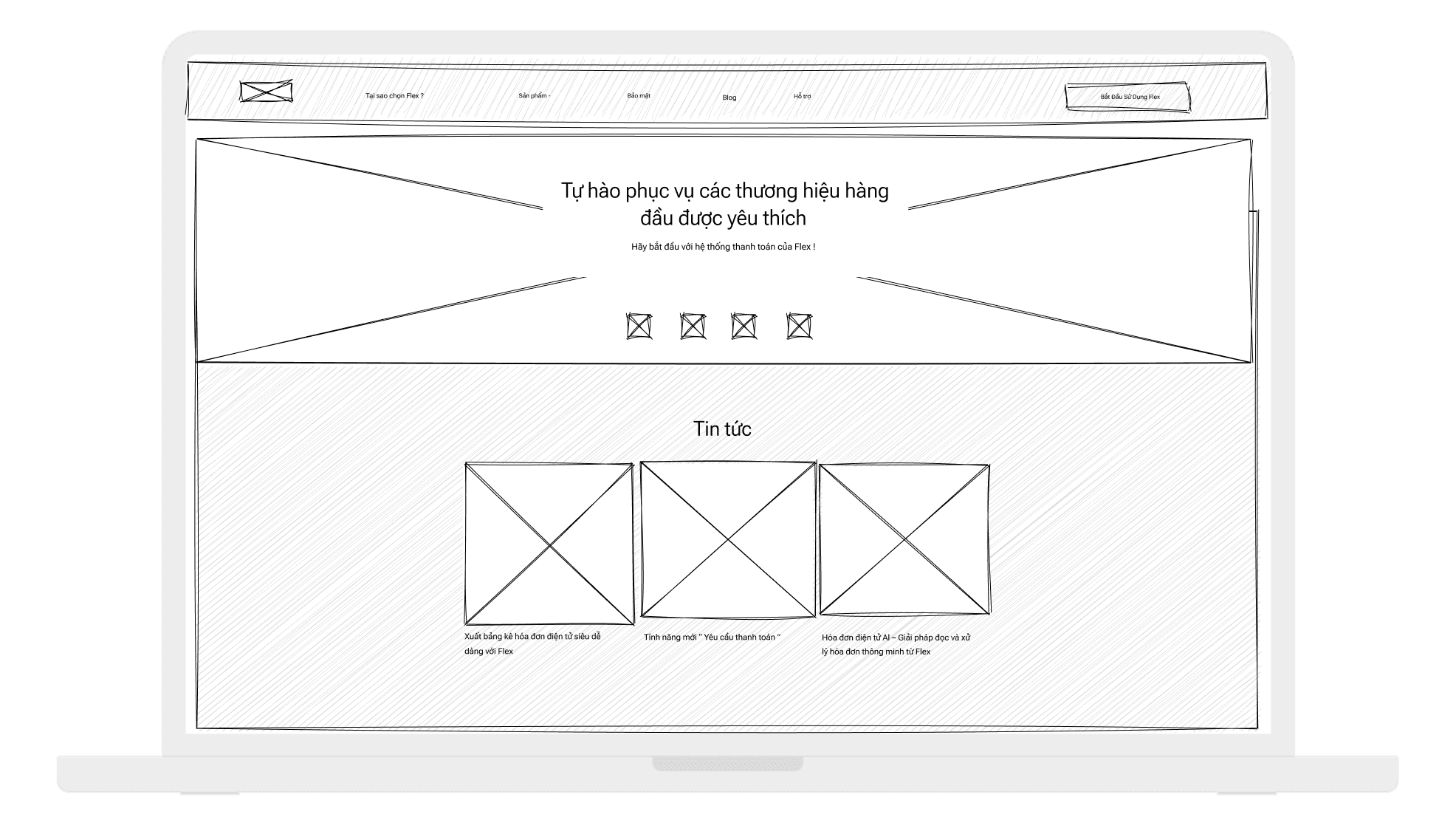

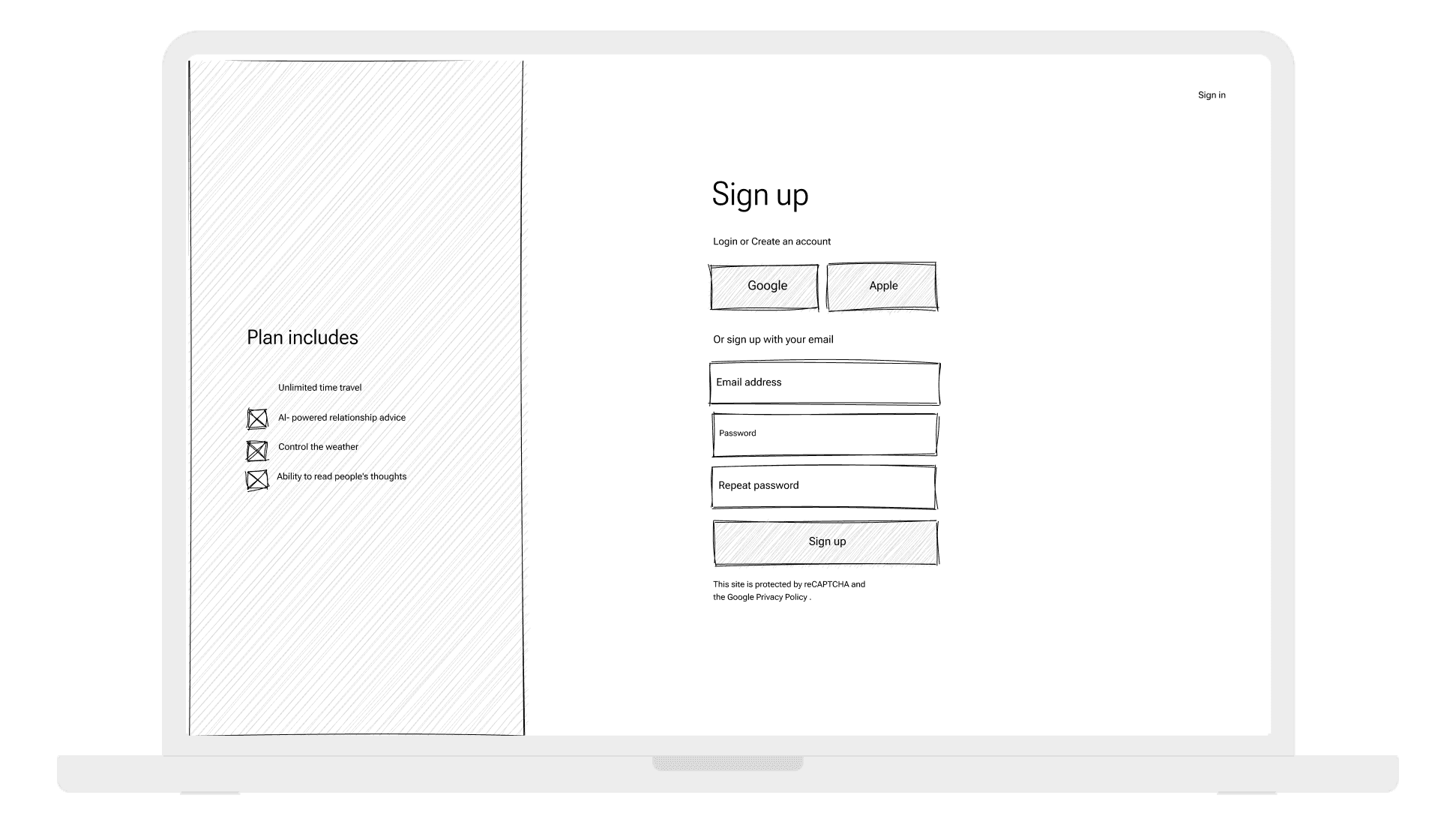

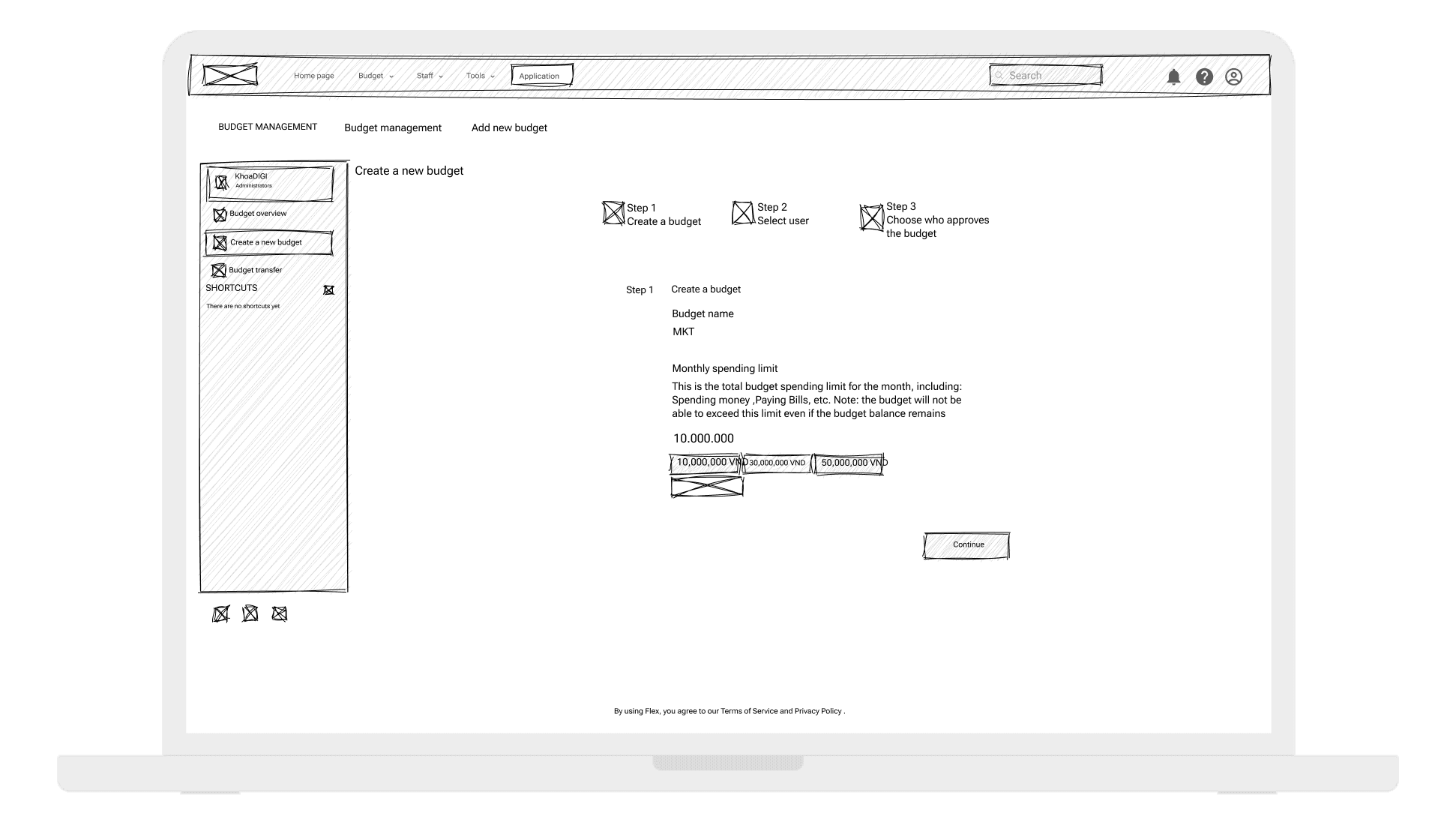

WIRE FRAME

HI-FI DESIGN

FLOW INVOICES

Key Learning

Small e-commerce businesses are increasingly in need of credit services that align closely with their unique operational needs and financial cycles. These businesses seek credit options that are scalable, flexible, and straightforward, emphasizing the importance of quick loan approvals to seize timely market opportunities. However, they often face challenges such as complex application processes, rigid repayment terms, which hinder their ability to leverage credit effectively.

Additionally, there is a significant gap in tailored financial advisory services available within credit platforms, which are essential for educating business owners about the impact of credit on their operations. Overall, for small e-commerce businesses to thrive, they need access to credit services that are not only efficient and clear but also integrated with educational support to help them make informed financial decisions.

Next Step

Develop Flexible Repayment Options: Create repayment plans that align with e-commerce revenue cycles, such as variable payments based on monthly sales figures.

Tailored Financial Advice: Incorporate customized financial advisory services within credit platforms, focusing on the unique challenges faced by e-commerce entrepreneurs.

Flex aim to enhance the accessibility, utility, and user-friendliness of credit services for small e-commerce businesses, fostering their growth and sustainability.