FLEX MONEY

Project Overview

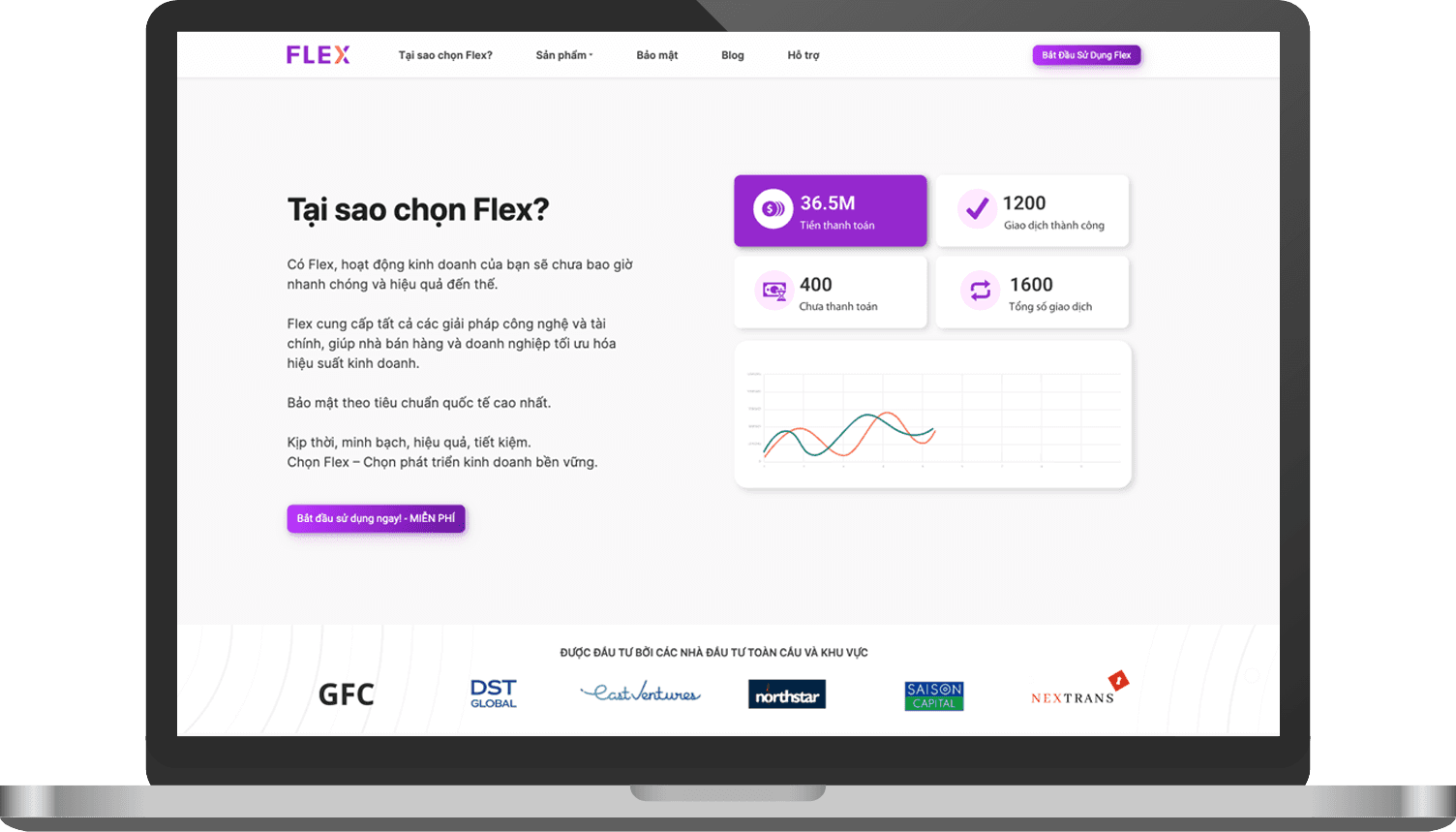

Flexmoney.vn is a dynamic B2B platform for Vietnamese businesses, offering seamless management and transaction solutions for both buyers and sellers.

Roles

Product Design

Market Research

UI/UX Development

Timelines

12 weeks

Problem

Small e-commerce business owners are often caught between the need for rapid financial agility to respond to market opportunities and the complexity of managing credit effectively within the rhythms of their unique business cycles.

Solution

Flex offers fast, flexible credit solutions fully integrated with e-commerce platforms. It streamlines credit for online businesses with quick approvals, clear terms, and tools for smart financial management.

Insights

Enhance Financial Accessibility

Customize Repayment Structures

Financial Health Monitoring

Observations

71%

Loan Approval Time

prioritize fast loan approval to keep pace with market demands.

82%

Interest Rates

small business owners consider low-interest rates crucial when choosing a credit service.

68%

Repayment Flexibility

e-commerce businesses look for flexible repayment options that align with their revenue patterns.

75%

Integration E-commerce Platforms

94%

User Interface

86%

Customer Support

Empathy map

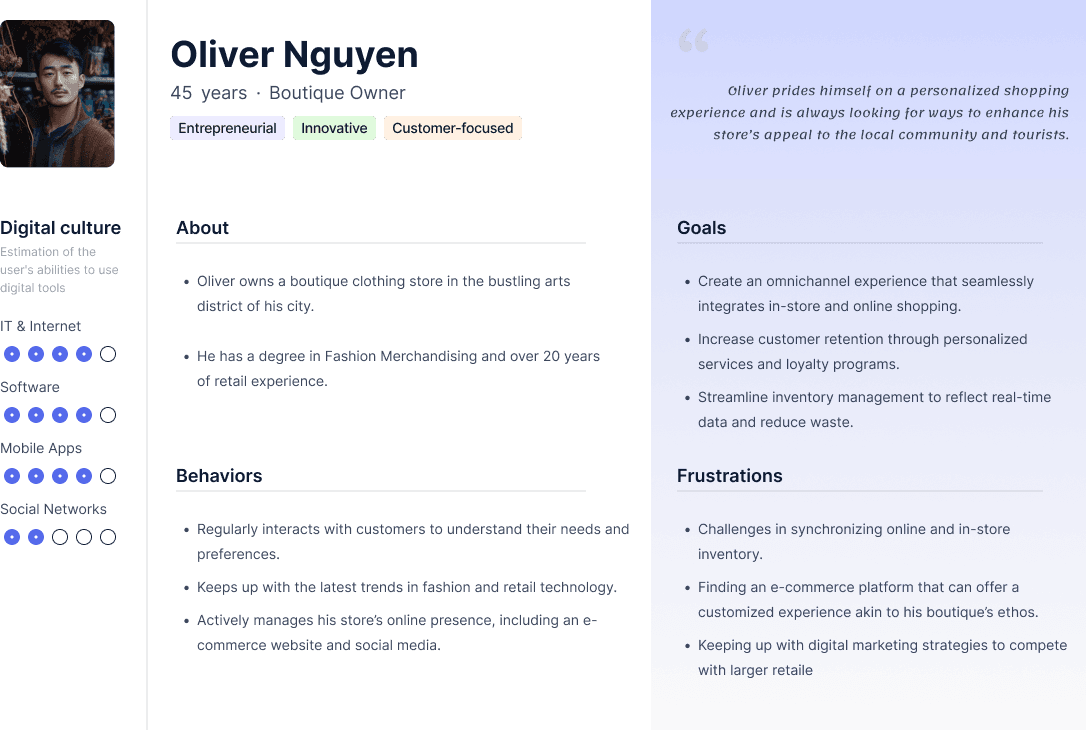

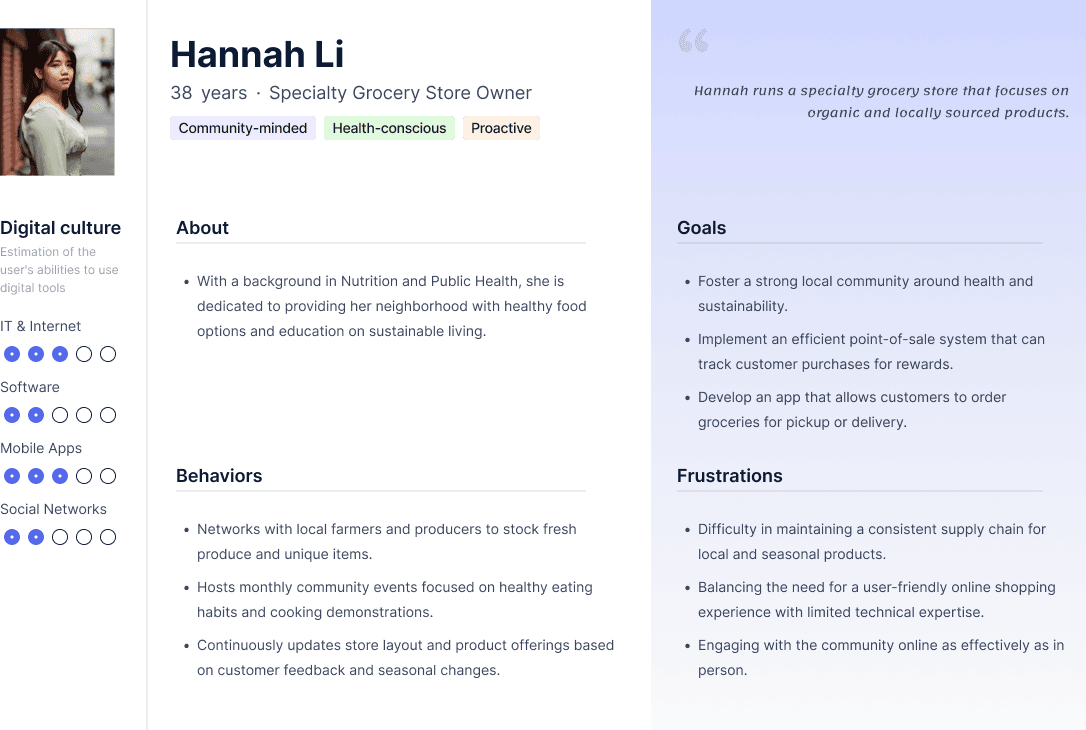

User personas

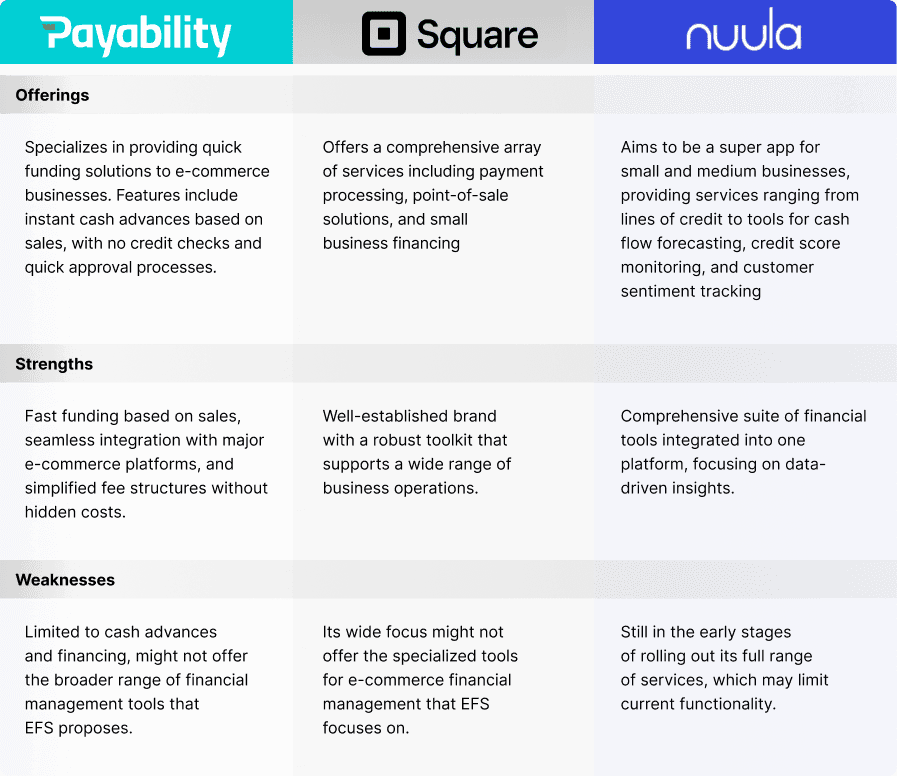

COMPETITIVE analysis

User Journey

Information architech

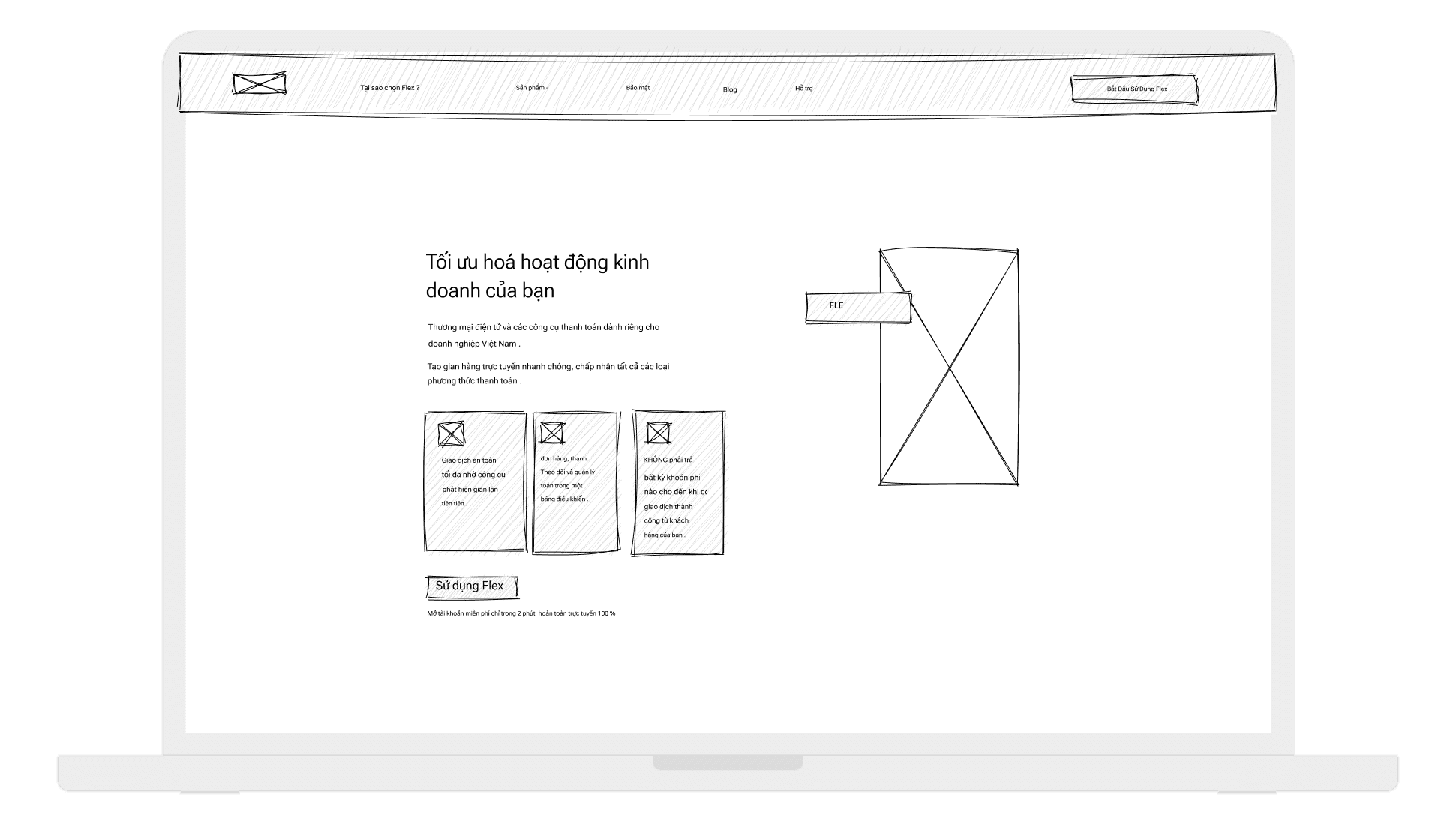

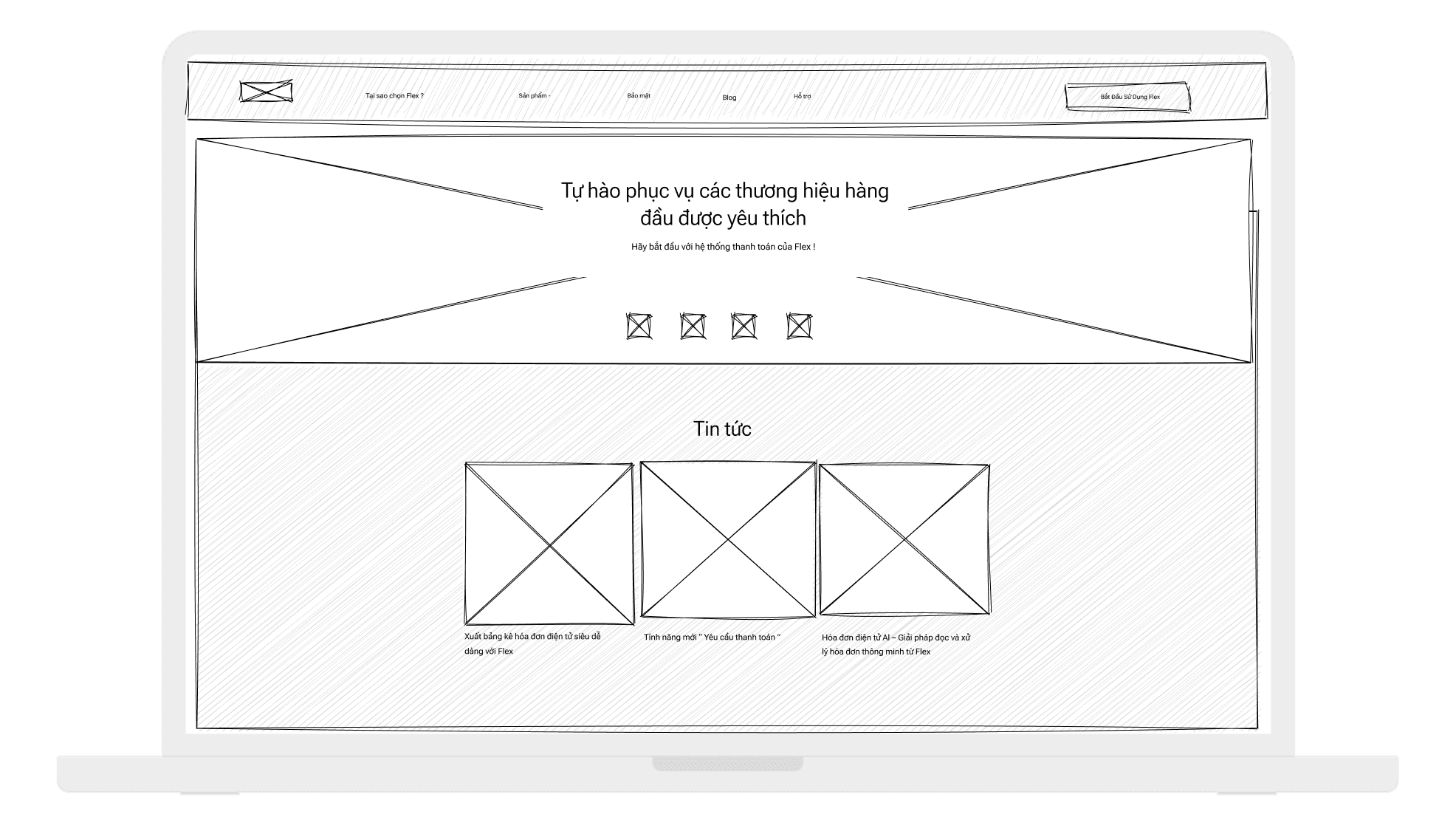

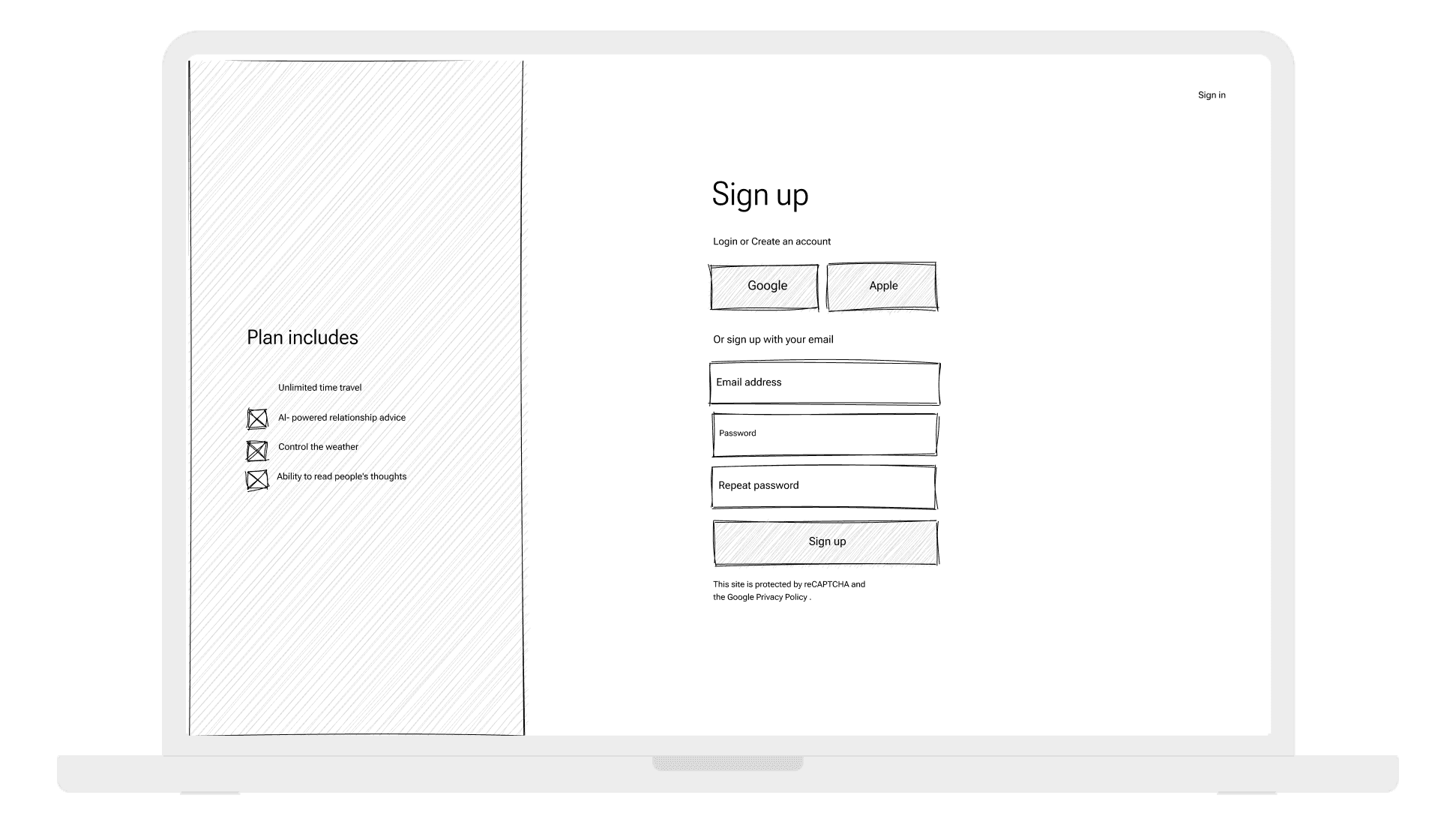

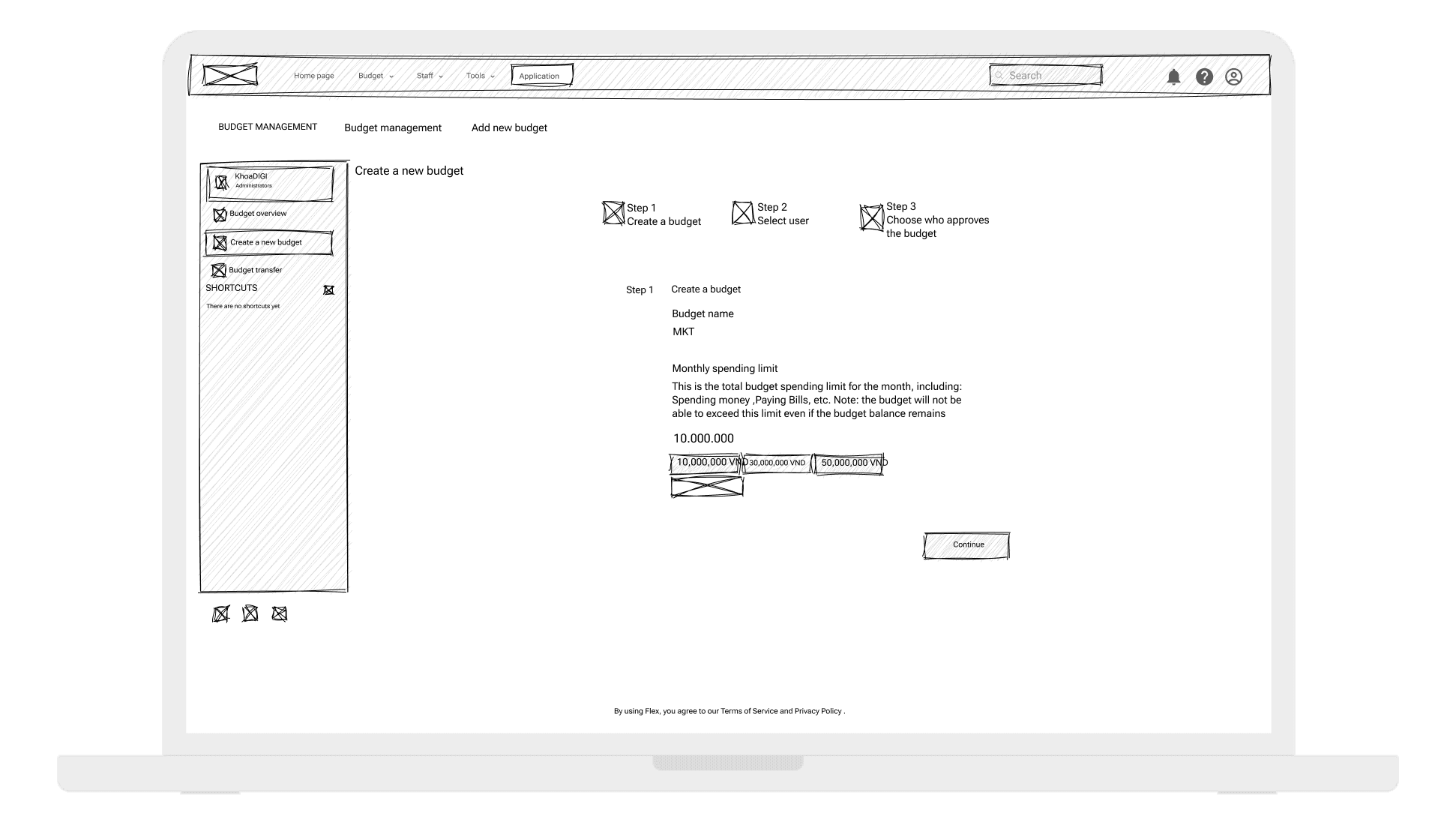

WIRE FRAME

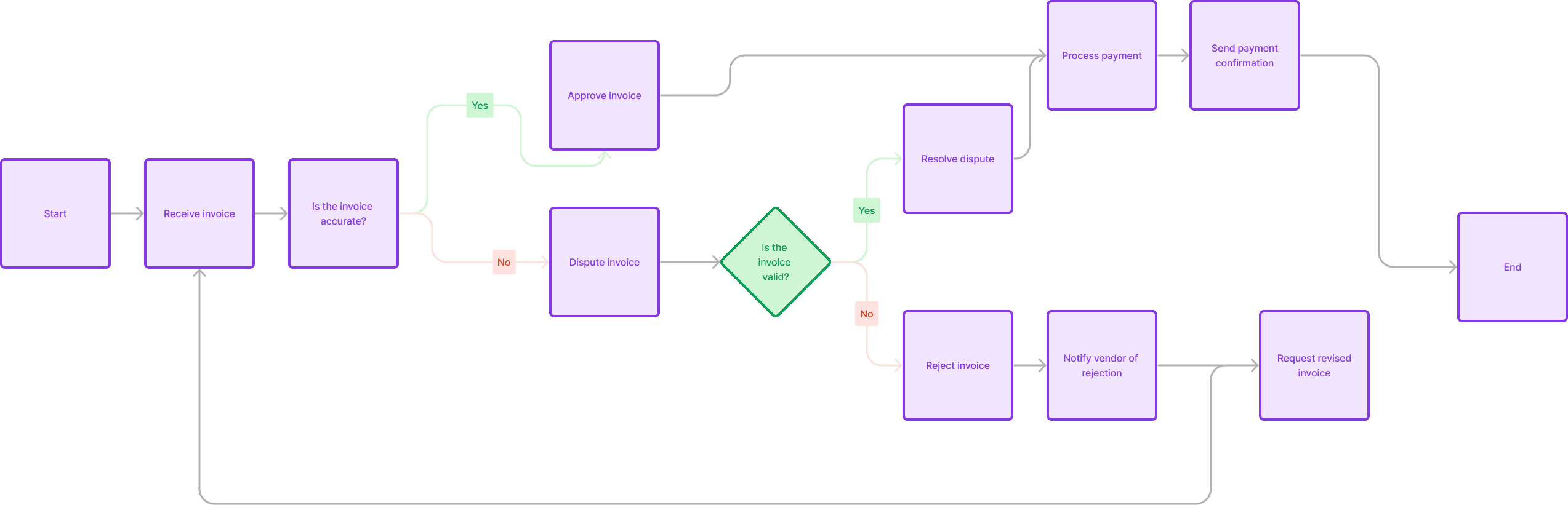

USER FLOW & HIFI DESIGN

Key Learning

Small e-commerce businesses need credit services tailored to their unique operations and financial cycles. They seek scalable, flexible, and straightforward credit options with quick loan approvals to capitalize on market opportunities.

Next Step

Develop flexible repayment options with variable payments based on monthly sales figures. Incorporate tailored financial advisory services within credit platforms to address e-commerce entrepreneurs' unique challenges. These initiatives aim to enhance the accessibility, utility, and user-friendliness of credit services, fostering growth and sustainability for small e-commerce businesses.